European

Hedge Fund Database

The Eurekahedge European Hedge Fund Database is a database of hedge funds that are either based in Europe or based outside of Europe (such as New York and San Francisco) but investing into it. Included in this database are a list of hedge funds in London and funds investing in the EMEA time zone; including the Middle East, Africa and Eastern Europe. All strategies are covered from single manager hedge funds, commodity trading advisors (CTAs), managed futures and long only absolute return funds.

Extensive Fund Coverage

The Eurekahedge European Hedge Fund Database contains 3 broad categories of funds with:

- the majority of funds being based in the Europe inclusive of London hedge funds, the Middle East and Africa

- a minority of funds based outside of EMEA (typically New York but also San Francisco, Greenwich, Grand Cayman and Stamford among others) but allocate exclusively to Europe

- a handful of very large hedge funds with significant investments in Europe. i.e. a billion dollar fund with a significant European exposure would feature in this database

Specific to the European hedge fund databases are funds that are UCITS compliant, AIFMD compliant and have HMRC reporting status.

The audience for the Eurekahedge European Hedge Fund Database are predominantly hedge fund investors such as pension funds, sovereign wealth funds, insurance companies, foundations, endowments, third party marketers and other capital raisers, family offices, funds of funds, managed account platforms, private banks, seeders and high net worth individuals.

Footnotes

1. As at 28 Nov 2024.

2. Live funds are those that are presumed to be actively trading.

3. We consider long only absolute returns funds as a subset of long short equity with a 'long bias'.

They have an identical business structure to a long short funds but tend to charge slightly lower fees.

4. Please note we are referring to funds and not management companies. There are many more management companies that run more than US$1bn in alternative assets that do not have a single billion dollar fund.

Databases by asset class

Comprehensive Data

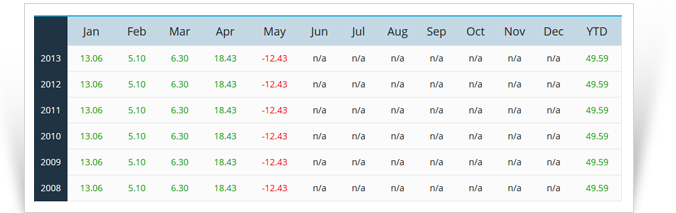

Eurekahedge databases track over 91 qualitative and data points and 39 statistical measurements per fund, making it easier to analyse managers performances.

Timely Updates

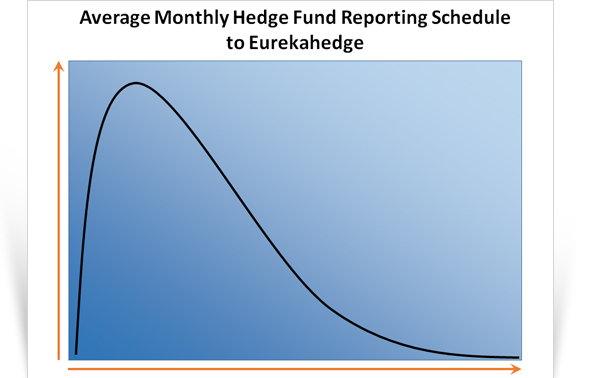

Eurekahedge provides access to the latest information you need for your investment decisions. 94% of all NAVs are updates by month-end.